Press release from Fred Thompson's Official Website: www.fred08.com/

Press release from Fred Thompson's Official Website: www.fred08.com/*******************

For Immediate Release

****************

Thompson Tax Plan for New Economic Growth

****************

New Options Move America Toward Fundamental Tax Reform

***************

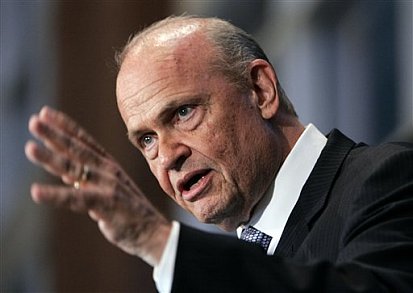

McLean, VA - Senator Fred Thompson today unveiled his Tax Relief and Economic Growth Plan, which will encourage new economic growth and move America toward fundamental tax reform. Thompson's seven-point plan makes it easier for small businesses to invest and grow, it would incentivize large employers keep jobs in the United States and would give taxpayers the flexibility to pay a simplified, flat tax rate.

"The solutions to challenges in our economy are found in the homes and small businesses of ordinary Americans, not in the halls of Washington," Thompson said. "My plan allows Americans to have greater control of their own money."

America's economy has endured several challenges over the last several years. Fred Thompson believes it is time to move forward and enter a new era of economic security and prosperity. The Thompson Plan for Tax Relief and Economic Growth provides commonsense solutions to increase American competitiveness in the 21st century.

To accomplish these goals, Fred Thompson's Plan for Tax Relief and Economic Growth will:

o Permanently Extend the 2001 and 2003 Tax Cuts. Unless action is taken, every American taxpayer will see a massive tax increase after December 31, 2010. This will impose an enormous financial burden on American families, slow economic growth, cost America jobs, and make it more difficult to address the country's long-term budget, economic, and security chal lenges. Tax relief enacted in 2001 and 2003 proved critical to generating a strong economy that has experienced growth despite the war on terror, the collapse in the housing market, and other economic challenges over the last six years. The Thompson keeps on the path to economic growth by ensuring the following:

§ Reduced individual income tax rates, saving every tax-paying family a minimum of $600.

§ Preserving the $1000 child tax credit, which was doubled from $500 per child.

§ Protecting Marriage penalty relief.

§ Retaining Education tax incentives, including Coverdell Education Savings Accounts, 529 college savings plans, and deductions for higher education expenses.

§ Reduced tax rates on capital gains and qualified dividends.

§ Increased expensing of investment for small businesses.

o Permanently Repeal the Death Tax. Current law provides death tax relief, but only through 2010. The death tax is inherently unfair. Under the Thompson Plan, the death tax would be permanently repealed, protecting millions of American families, including small business owners and family farmers, from double taxat ion at rates ranging as high as 55 percent.

o Repeal the Alternative Minimum Tax. The AMT is a separate tax system created 30 years ago to ensure that a few high income Americans could not use deductions and credits to eliminate their tax liability. However, because the AMT is not indexed to inflation, it is penalizing Americans it was never intended to affect. The Thompson plan would index the exemption amounts annually so that millions of middle class families will not become subject to this tax.

o Reduce the Corporate Tax Rate. The United States has one of the highest rates of tax on businesses of the industrialized nations, second only to Japan. Studies suggest the U.S. Treasury is actually losing tax revenue by keeping the corporate tax rate so high. In order to increase the competitiveness of U.S. comp anies in the global marketplace, the Thompson plan would reduce the U.S. top corporate tax rate from 35 percent to no more than 27 percent, which is the approximate average of the world's leading economies. This tax reduction will promote U.S. competitiveness, encourage companies to keep their operations (and jobs) in the U.S., and spur continued economic expansion and growth.

o Permanently Extend Small Business Expensing. Small businesses create two-thirds of all new jobs in America, and employ nearly 59 million Americans - more than half of the nation's private-sector workforce. Women own a quarter of all small businesses, minorities are nearing the 20% mark, and Hispanic Americans are opening their own businesses at a rate thre e times the national average. Current law allows small businesses to write-off purchases of equipment of up to $125,000 per year, rather than depreciating those assets over time. Making expensing of equipment and other small business items permanent will encourage greater investment and growth.

o Update and Simplify Depreciation Schedules. The current depreciation schedules are outdated and in many cases do not reflect the realistic useful life of an asset. This is particularly true for investments in high technology. For example, computers must be depreciated over three years, even though they become ob solete in half that time. The Thompson plan would simplify and update these schedules to allow American businesses to make the investments they need to compete and create more high-quality jobs.

o Expand Taxpayer Choice. The Thompson plan would give Americans greater choice, by giving them the option of remaining under the current, complex tax code or opting for a simplified, flat tax code. The simplified tax code would contain two tax rates: 10% for joint filers on income of up to $100,000 ($50,000 for s ingles) and 25% on income above these amounts. The standard deduction would be more than doubled to $25,000 for joint filers and $12,500 for singles. The personal exemption amount would be increased to $3,500. Therefore, a family of 4 would be exempt from income tax on the first $39,000 of income. The simplified tax code would contain no other tax credits or deductions. It would also retain the 15% tax rate on capital gains and dividends. This approach would dramatically simplify taxes for tens of millions of Americans. This proposal would serve as a stepping-stone to fundamental tax reform.

Read Thompson's entire plan for Tax Relief and New Economic Growth here: http://www.fred08.com/virtual/taxrelief.aspx

********************

conservative+Fred+Thompson+for+President

No comments:

Post a Comment